More Than Just Financing

By integrating trade management, logistics and funding solutions through advanced technology, our platform enables businesses to optimise operations, improve cashflow and accelerate business in current and new markets.

Flow's Mission

Our mission is to support our customers overcome cashflow gaps, by providing a suite of services through cutting edge technology that aim to enhance efficiencies in distribution, operations and capital management.

Challenges in Today's Global Trade

For Importer

Payment Risk

Risk of paying for goods that don't meet specifications or aren't delivered as agreed.

Working Capital Constraints

Need to pay suppliers upfront while waiting for inventory to sell, creating cash flow pressure.

Currency Fluctuations

Exposure to exchange rate changes between order placement and payment.

Regulatory Compliance

Navigating complex import regulations, duties, and taxes across different jurisdictions.

Supply Chain Visibility

Limited visibility into the location and status of goods during transit.

For Exporter

Non-Payment Risk

Risk of buyers failing to pay after goods have been shipped.

Cash Flow Gaps

Long payment terms creating gaps between production costs and payment receipt.

Political Risk

Exposure to political instability, policy changes, or sanctions in buyer countries.

Production Capacity Limitations

Inability to fulfill large orders due to working capital constraints.

Documentation Complexity

Managing complex export documentation, certificates, and compliance requirements.

Our Services

Industries We Focus On

FMCG

Semiconductors and Electronic Components

Decarbonization Technology Goods

Agriculture

TRADE MANAGEMENT

PURCHASE ORDER (PO) MANAGEMENT

Streamline the creation, tracking, and fulfillment of purchase orders with full visibility.

SALES ORDER (SO) MANAGEMENT

Manage incoming sales orders efficiently, ensuring accurate processing and timely fulfillment.

SECURE INTERNATIONAL PAYMENT PROCESSING

Enable smooth, multi-currency transactions with automated payment workflows.

LOGISTICS MANAGEMENT

ORIGIN SERVICES

Comprehensive support at source, including procurement coordination and export compliance.

DESTINATION SERVICES

Efficient last-mile delivery, strategic warehousing, and inventory allocation tailored to market needs.

CUSTOMS & REGULATORY COMPLIANCE

Expert management of import/export procedures, documentation, and duties to ensure smooth cross-border operations.

CREDIT FUNDING SOLUTIONS

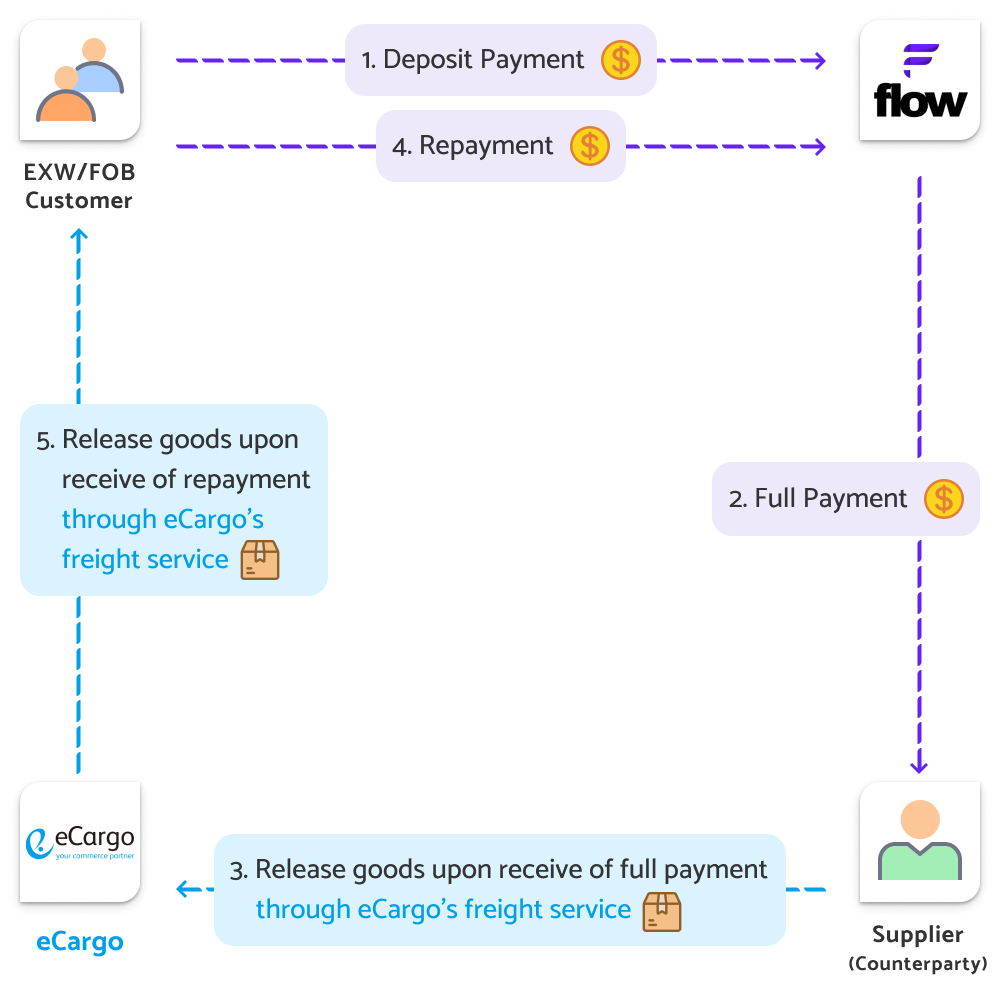

FLOWPO

Purchase Order Funding

Boost procurement power. FLOWPO pays your suppliers upfront so you can fulfill large orders without tying up capital.

FLOWSTOCK

Inventory Funding

Turn stock into cash. FLOWSTOCK unlocks working capital from inventory to support ongoing purchases and maintain optimal levels.

FLOWCREDIT

Open Credit Funding

Flexible credit, scalable growth. FLOWCREDIT offers open purchasing lines with repayment terms linked to your sales performance.

How Flow Works

Register an account

Sign up and get quick approval

Agree on the terms

Confirm and activate your account

Execute your trade

Start trading instantly with Flow backing you

Our Advantages

Global Infrastructure

Backed by 80+ offices across 30+ countries and 120+ warehouse globally, Flow delivers seamless logistics, operational support, and cross-border execution.

Highly Experienced Team

Multilingual team across different regions with deep expertise in supply chain supporting your business round-the-clock.

Full Transparency

Gives you real-time visibility into your trade flows and funding status. Every shipment, document and charge is clearly tracked, with no hidden costs.

Fast Funding Decisions

Experience quick, data-driven approval processes, allowing you to seize growth opportunities without delay.

AI-Powered Decisioning

AI-powered analysis that accelerates approvals, strengthens risk assessment, and ensures smarter funding decisions.

Minimum Requirements to Register with Flow

Two years of operations

Revenue USD 500K+ per year

Trade internationally

Minimum transaction value USD 25K

Funding Solutions for Real Trade Challenges

Long payment terms, supplier deadlines and shipment costs can squeeze your cashflow. Flow provides funding anchored in your trade flows and data, helping you pay suppliers, hold inventory and manage receivables without slowing your business down.

Flow's 3 Funding Solutions

FLOWPO - Purchase Order Funding

Buy Now, Pay Later. FLOWPO pays your suppliers upfront so you can fulfill large orders without locking capital in inventory.

Flexible 30/60/90 day credit terms to support seller growth

Key Benefits

Fulfilling Large Orders

Increased capacity to handle and complete bigger customer orders.

No Order Rejections

Eliminates the need to decline orders due to limited funds.

Better Supplier Ties

Fosters stronger relationships with suppliers via timely payments.

Faster Business Expansion

Enables quicker growth and scaling of the overall business.

FLOWSTOCK - Inventory Funding

Turn stock into cash. FLOWSTOCK unlocks working capital from inventory to support ongoing purchases.

Flow funds up to 80% of inventory value of the goods that are stored at eCargo's warehouse

Flexible 30/60/90 day credit terms to support seller growth

Key Benefits

Release Working Capital

Free up funds tied in inventory.

Maintain Optimal Stock Levels

Ensure efficient inventory management.

Manage Seasonal Fluctuations

Adapt to changing demand patterns.

Invest in Growth Opportunities

Allocate resources for expansion.

FLOWCREDIT - Flexi-Funding Solutions

Helping companies navigate complex supply chains with tailor-made solutions

Flow pays the supplier directly on behalf of the seller

Flexible 30/60/90-day credit terms to support seller growth

Key Benefits

Cash Flow

Better control of incoming funds.

Credit Management

Better handling of credit and debt.

Order Capacity

Capability to fulfill bigger client requests.

Payment Terms

Adaptable conditions for paying invoices.

Start Your Funding in 3 Steps

Adjust the sliders to view your estimated amount. Reach out to us for a tailored offer.

Average Monthly Revenue (USD)

Average revenue per month (last 6–12 months)

Type of Goods Traded

E.g. electronics, apparel, food & etc.

Payment Terms (Days)

E.g. 30, 60 or 90 days

The credit limit from this calculation are for general reference only and based on the information provided. The actual credit limit granted will depend on Flow's terms, conditions, lending criteria and credit assessment of your risk profile, which may change from time to time.

Amount Eligibility*

Monthly Service Fee*

1%-1.5%

Contact Us

Your enquiry is being sent

Thank you for contacting us! We will get back to you shortly.